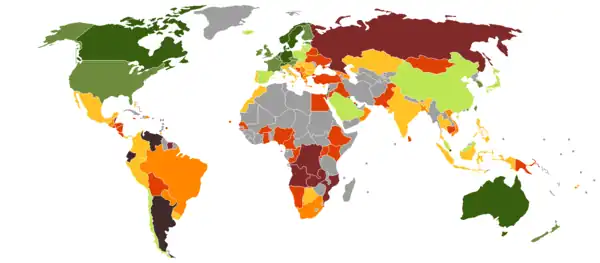

Liste des pays par note souveraine

Liste de notes souveraines par pays pour les trois principales agences de notation financière : Standard & Poor's, Fitch et Moody's.

| Signification de la note |

Moody’s | Standard & Poor’s |

Fitch Ratings | |||

|---|---|---|---|---|---|---|

| Long terme | Court terme |

Long terme | Court terme |

Long terme | Court terme | |

| Prime Première qualité |

Aaa | P-1 Prime -1 | AAA | A-1+ | AAA | F1+ |

| High grade Haute qualité |

Aa1 | AA+ | AA+ | |||

| Aa2 | AA | AA | ||||

| Aa3 | AA− | AA− | ||||

| Upper medium grade Qualité moyenne supérieure |

A1 | A+ | A-1 | A+ | F1 | |

| A2 | A | A | ||||

| A3 | P-2 | A− | A-2 | A− | F2 | |

| Lower medium grade Qualité moyenne inférieure |

Baa1 | BBB+ | BBB+ | |||

| Baa2 | P-3 | BBB | A-3 | BBB | F3 | |

| Baa3 | BBB− | BBB− | ||||

| Non-investment grade, speculative Spéculatif |

Ba1 | Not prime Non prime | BB+ | B | BB+ | B |

| Ba2 | BB | BB | ||||

| Ba3 | BB− | BB− | ||||

| Highly speculative Très spéculatif |

B1 | B+ | B+ | |||

| B2 | B | B | ||||

| B3 | B− | B− | ||||

| Risque élevé | Caa1 | CCC+ | C | CCC | C | |

| Ultra spéculatif | Caa2 | CCC | ||||

| En défaut, avec quelques espoirs de recouvrement |

Caa3 | CCC− | ||||

| Ca | CC | CC | ||||

| C | C/CI/R | C | ||||

| En défaut sélectif | SD | D | RD | D | ||

| En défaut | D | D | ||||

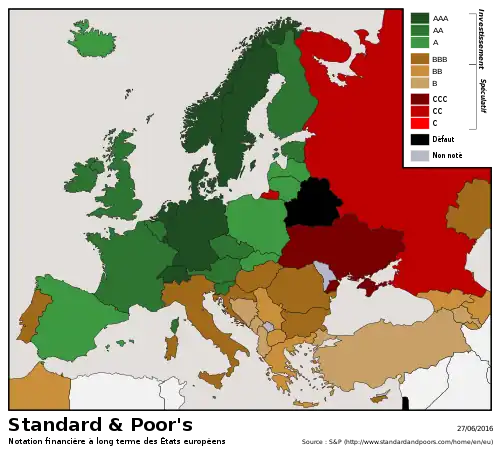

Standard & Poor's

Notation financière des États européens par Standard & Poor's, 19 novembre 2015.

| Pays | Note | Perspective | Dernière modification | Source |

|---|---|---|---|---|

| B+ | Stable | février 2016 | [3] | |

| BBB | Stable | avril 2020 | ||

| CCC+ | Stable | mars 2020 | [3] | |

| SD | Négative | avril 2020 | [4] | |

| A- | Négative | |||

| AAA | Négative | avril 2020 | ||

| AA+ | Stable | janvier 2013 | ||

| BB+ | Stable | janvier 2018 | ||

| BBB+ | Stable | |||

| BBB | Négative | |||

| BB- | Stable | avril 2010 | ||

| B- | Stable | |||

| B | Négative | |||

| AA | Stable | [5] | ||

| B | Stable | |||

| B | Stable | |||

| AA | Stable | |||

| BB- | Stable | |||

| B | Stable | |||

| A- | Stable | |||

| BB+ | Stable | |||

| BBB | Stable | mai 2020 | ||

| B | Stable | mai 2017 | ||

| B+ | Stable | |||

| B | Stable | |||

| AAA | Stable | |||

| B+ | Stable | |||

| AA- | Positive | [6] | ||

| A- | Stable | [7] | ||

| BBB | Stable | |||

| BB- | Négative | |||

| BB | Stable | |||

| BBB- | Négative | |||

| A- | Négative | |||

| AA- | Positive | |||

| AAA | Stable | |||

| B | Positive | |||

| AA | Stable | |||

| B- | Stable | |||

| B- | Négative | [8] | ||

| BB- | Stable | |||

| A | Positive | |||

| B- | Positive | |||

| AAA | Stable | |||

| AA | Stable | [9] | ||

| BB- | Stable | |||

| B+ | Positive | |||

| AAA | Stable | janvier 2012 | ||

| B | Stable | |||

| BB- | Stable | [10] | ||

| B- | Stable | |||

| BB | Stable | |||

| AAA | Stable | |||

| B | Stable | |||

| AAA | Stable | [11] | ||

| BBB- | Négative | |||

| BBB- | Négative | |||

| BBB- | Stable | |||

| BB+ | Positive | |||

| AA- | Stable | |||

| AAA | Stable | |||

| AA | Stable | |||

| BBB | Négative | |||

| B- | Stable | |||

| A+ | Stable | [12] | ||

| BB | Négative | |||

| BBB | Stable | |||

| B+ | Stable | |||

| AA- | Stable | |||

| BB+ | Positive | |||

| SD | ||||

| NR | [3] | |||

| AAA | Stable | |||

| BBB | Stable | |||

| AAA | Stable | [13] | ||

| BB | Stable | |||

| A- | Stable | |||

| A | Stable | |||

| BBB+ | Stable | |||

| BB- | Stable | |||

| BB | Négative | |||

| BBB- | Positive | |||

| BBB- | Stable | |||

| B+ | Stable | |||

| AAA | Stable | |||

| AA+ | Négative | |||

| B+ | Stable | |||

| AAA | Stable | |||

| A | Négative | |||

| B- | Stable | [14] | ||

| BBB | Stable | |||

| B+ | Stable | |||

| BB | Positive | [15] | ||

| BBB+ | Stable | [16] | ||

| BB | Stable | |||

| A- | Stable | |||

| BBB | Stable | |||

| AA | Stable | |||

| BB+ | Stable | |||

| CC | Négative | Mar 2022 | [17] | |

| AA- | Stable | |||

| B+ | Négative | |||

| BB | Stable | |||

| AAA | Stable | |||

| A+ | Stable | |||

| AA | Négative | Jan 2011 | [18] | |

| BBB+ | Stable | |||

| A | Stable | |||

| A | Stable | |||

| B+ | Stable | |||

| B+ | Positive | |||

| AAA | Stable | |||

| AAA | Stable | |||

| AA- | Stable | |||

| BBB+ | Stable | |||

| A | Stable | |||

| B | Négative | |||

| BB | Positive | |||

| B+ | Stable | |||

| B+ | Stable | |||

| AA | Négative | octobre 2022 | [19] | |

| AA+ | Stable | juin 2013 | ||

| BBB | Stable | |||

| B+ | Stable | |||

| BB- | Négative | |||

| B+ | Stable | |||

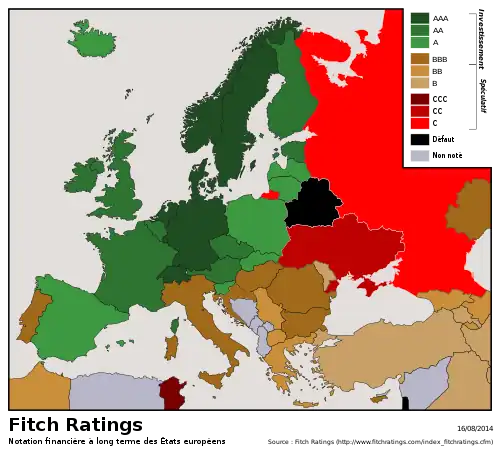

Fitch

Notation financière des États européens par Fitch Ratings, 16 août 2014.

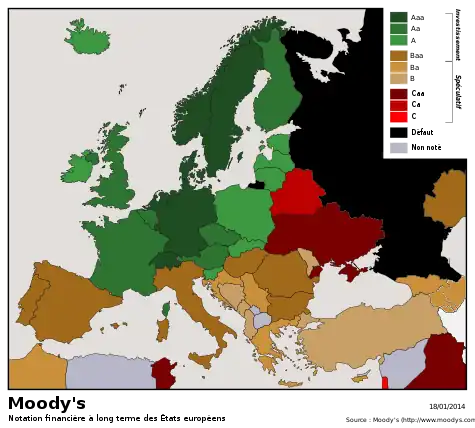

Moody's

Notation financière des États européens par Moody's, 18 janvier 2014.

| Pays | Note | Perspective | Date | Source |

|---|---|---|---|---|

| B1 | Négative | Aout 2017 | [23] | |

| B3 | Stable | [24] | ||

| Baa1 | Négative | [25] | ||

| Baa1 | Négative | [26] | ||

| Baa2 | Positive | [27] | ||

| Aa3 | Stable | [28] | ||

| Baa3 | Stable | [29] | ||

| Aa2 | Stable | [18] | ||

| Baa2 | Positive | [30] | ||

| Aa2 | Positive | [31] | ||

| AAA | Stable | [32] | ||

| Baa2 | Stable | [33] | ||

| Ba3 | Stable | Novembre 2020 | [34] | |

| A2 | Stable | [35] | ||

| Baa3 | Négative | [36] | ||

| Aa2 | Négative | [37] | ||

| Baa3 | Positive | [38] | ||

| C | [39] | |||

| A3 | [40] | |||

| Ba2 | Positive | |||

| A3 | Stable | [41] | ||

| Ba1 | Positive | [42] | ||

| Ca | Négative | [43] | ||

| Aa2 | Stable | [44] | ||

| Caa2 | Négative | [45] | ||

Notes

Sources

Cet article est en partie issu de l'article hispanophone correspondant.

- (en) « S&P | Ratings Sovereigns Ratings List | Americas », Standard & Poor's (consulté le )

- Reference for the United States: (en) « United States of America Long-Term Rating Lowered To 'AA+' On Political Risks And Rising Debt Burden; Outlook Negative » [archive du ], Standard & Poor's (consulté le )

- Sovereign Rating And Country T&C Assessment Histories | Standard & Poor's

- S&P gives Belgium credit rating warning amid political uncertainty | Business | The Guardian

- (es) « Standard & Poor's eleva calificación soberana de Chile en un escalón a "AA-" / Emol.com », El Mercurio, (lire en ligne, consulté le ).

- « Pékin furieux après la dégradation de sa note par Standard & Poor’s », lesechos.fr, (lire en ligne, consulté le )

- (es) « S&P rebaja la calificación crediticia de Egipto a B- por la crisis política », sur Diario Financiero (consulté le ).

- "Standard and Poor's confirme la note AA et relève la perspective de la France". Le Figaro. 21 October 2016

- "Greece slips further toward default as its credit rating is cut to CCC". The Guardian. 13 June 2011

- Government welcomes S&P's decision to upgrade Hong Kong's Sovereign Credit Ratings to 'AAA' | Hong Kong SAR Government Press Release

- S&P cuts Japan sovereign rating outlook on quake costs | Reuters

- Grand Duchy of Luxembourg 'AAA/A-1+' sovereign ratings affirmed on continued strong financials; Outlook Stable | paperJam

- Pakistan’s Credit Rating to Remain Stable, S&P Says | Businessweek

- Russia - Credit Rating | tradingeconomics

- Slovenia to Sell as Much as 1.5 Billion Euros in Bonds | Businessweek

- « Les places financières européennes en forte baisse, la note de la dette britannique abaissée », Le Monde, (lire en ligne).

- « Fitch Downgrades Lebanon's Long-Term Foreign-Currency IDR to 'RD' », fitchratings, (lire en ligne).

- « https://tradingeconomics.com/russia/rating », tradingeconomics, (lire en ligne).

- « Fitch Downgrades Tunisia to 'CCC-' », fitchratings.com, (lire en ligne).

- [ https://m.moodys.com/credit-ratings/Angola-Government-of-credit-rating-806356845]

- Moody's downgrades Bahrain to Baa1 with negative outlook

- Moody's downgrades Barbados' domestic currency rating to Baa3; outlook negative

- Moody's upgrades Colombia's bond ratings

- Moody’s Warns U.S. Debt Could Test Triple-A Rating - NYTimes.com

- Moody's upgrades the Philippines' sovereign ratings to Ba2; outlook stable

- « Rating Action: Moody's upgrades Greece's rating to Ba3, outlook remains stable », Moody's, (consulté le )

- Moody's cuts Ireland by two notches - Reuters

- Moody's downgrades Italys government bond rating to Baa2 from A3

- Moody's cuts outlook for Japan credit rating from stable to negative on massive national debt - Yahoo! Canada Finance

- Moody's assigns Baa3 rating to Latvia government bond

- Moody's downgrades Lebanon's rating to C from Ca

- « Moody's eleva a A3 a México »(Archive.org • Wikiwix • Archive.is • Google • Que faire ?) (consulté le )

- Russia - Credit Rating

- [ http://www.la-croix.com/Economie/Monde/Le-Brexit-baisse-note-Royaume-Uni-2017-09-23-1200879133]

- Moody's downgrades Tunisia's ratings

Voir aussi

Cet article est issu de wikipedia. Text licence: CC BY-SA 4.0, Des conditions supplémentaires peuvent s’appliquer aux fichiers multimédias.